The Money Multiplier Describes How Much

The money multiplier and the expansion of the money supply. A More Sophisticated Money Multiplier for M1 LEARNING OBJECTIVES 1.

Money Multiplier Intelligent Economist

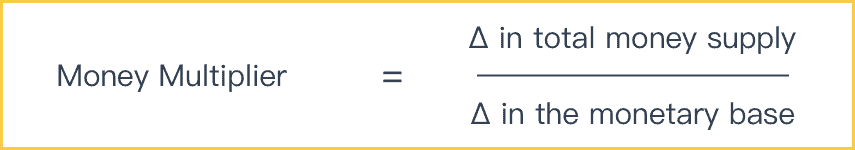

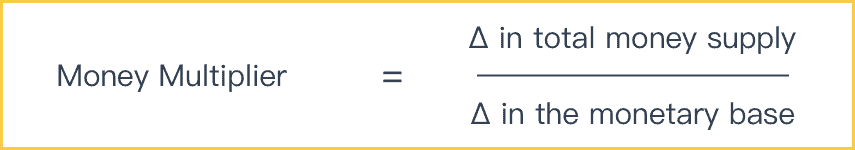

Definition of Money Multiplier.

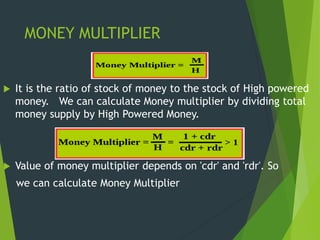

. Most simply it can be defined either as the statistic of commercial bank moneycentral bank money based on the actual observed quantities of various empirical measures of money supply such as M2 broad money over M0 base money or it can be the theoretical maximum commercial bank moneycentral bank. The money multiplier is an important concept for central banks. The deposit multiplier provides.

This means that for every 100 of deposits you can only lend out 090. 24 The value of a European style call option is the sum of two components. How does one get his or her money back from a consol bond.

Once you have m plug it into the formula ΔMS m ΔMB. Economics Project Class 12. The simple money multiplier or deposit multiplier measures how much money a certain deposit can create when the banking sector engages in fractional reserve banking.

Describe how central banks influence the money supply. The equation of exchange is a theory that connects the _____ of money with GDP. Money and Banking Progress You are on question 13 of 13 The money multiplier describes how much O consumer demand increases following an increase in government spending.

It is the minimum ratio of deposits that is legally required to be kept by the commercial banks of the economy with themselves and with the central bank of India also known as the RBI. View the full answer. Money multiplier 1r Where r Required reserve ratio or cash reserve ratio It means that if the reserve ratio is higher then the money multiplier will be lower and the banks need to.

Required reserves excess reserves and bank behavior. The multiplier effect refers to any changes in consumer spending that result from any real GDP growth or contraction brought about by the use of fiscal policy. So if m 1 26316 and the monetary base increases by 100000 the money supply will increase by 263160.

The country has a money multiplier of 1. The money multiplier is the amount of money that banks generate with each dollar of reserves. Central banks can also modify the money multiplier by changing the reserve requirements.

A money multiplier of 20 means that the bank has 20 times as much in deposits as it does in reserves. The formula to calculate the money multiplier is represented as follows. When government increases its spending it stimulates aggregate demand and causes some real GDP growth.

The money multiplier describes how much a change in reserves affects _____ deposits. The money multiplier reflects the amplified change in the money supply that ultimately results from the injection into the banking system of additional reserves. Banking and the expansion of the money supply.

The money multiplier tells us by how many times a loan will be multiplied as it is spent in the economy and then re-deposited in other banks. Money creation in a fractional reserve system. Reserves is the amount of deposits that the Federal Reserve requires banks to hold and not lend.

Numerator of the M2 money multiplier. Money Multiplier 1 Reserve Ratio You are free to use this image on your website templates etc Please provide us with an attribution link How to Provide Attribution. In short it is.

Example of Money Multiplier Hypothetical. Money Multiplier 1LRR or 1r. The money multiplier is defined in various ways.

Money multiplier 1required reserve ratio 1100 1. Relevance and Use of Money Multiplier Formula. Introduction to fractional reserve banking.

That growth creates jobs and more workers earn income. The money multiplier essentially tells economists how much the money supply could increase as banks excess reserves increase. From the perspective of banking economics the money multiplier is a very important concept as it is a key element of the fractional banking system that controls the.

Describe how banks borrowers and depositors influence the money supply. According to the equation of exchange if the velocity of money is 4 and the money supply is 2000 then _____ GDP is 8000. O the money supply increases in response to an increase in bank deposits.

According to this if the economy needs 5000000000 and the current reserve requirement is 70 the monetary multiplier is only 1 7 142. The example to describe. How do the simple money multiplier and the more sophisticated one developed here contrast and compare.

OGDP increases as a result of an increase in investment expenditure. Bank balance sheet free response question. If m 1 45 and MB decreases by 1 million the money supply will decrease by 45 million and so.

The money multiplier is nothing but an indication of how initial deposit can create a higher amount of money in the supply of money. This means that the Federal Reserve needs to inject 5000000000 x 07 3500000000. M S m M B.

Money Multiplier 1 Required Reserve Ratio. 1 20 20 1 20. We start with the observation that we can consider the money supply to be a function of the monetary base times some money multiplier m.

The formula is 1 r where r is the reserve ratio. Fortunately a formula exists for calculating the total of these many rounds of lending in a banking system. In a multi-bank system the amount of money that the system can create is found by using the money multiplier.

No money creation is possible because in response to an increase in bank collaterals of say 100 million Ishkebar dollars I the money supply will increase by 1 I100 million I100 million. Click to see full answer. A steeply upward sloping yield curve indicates that short-term interest rates are expected to.

Conversely if the FED reduces the reserve requirement to 10 the money multiplier is 1 1 10. Where LRR is the legal reserve ratio.

Solved Money And Banking Progress You Are On Question 13 Of Chegg Com

No comments for "The Money Multiplier Describes How Much"

Post a Comment